dependent care fsa eligible expenses

The cost of routine skin care face creams etc does not qualify. A Dependent Care FSA can be used for expenses incurred to care for children age 12 and younger as well as adult tax dependents who are unable to care for themselves while you are.

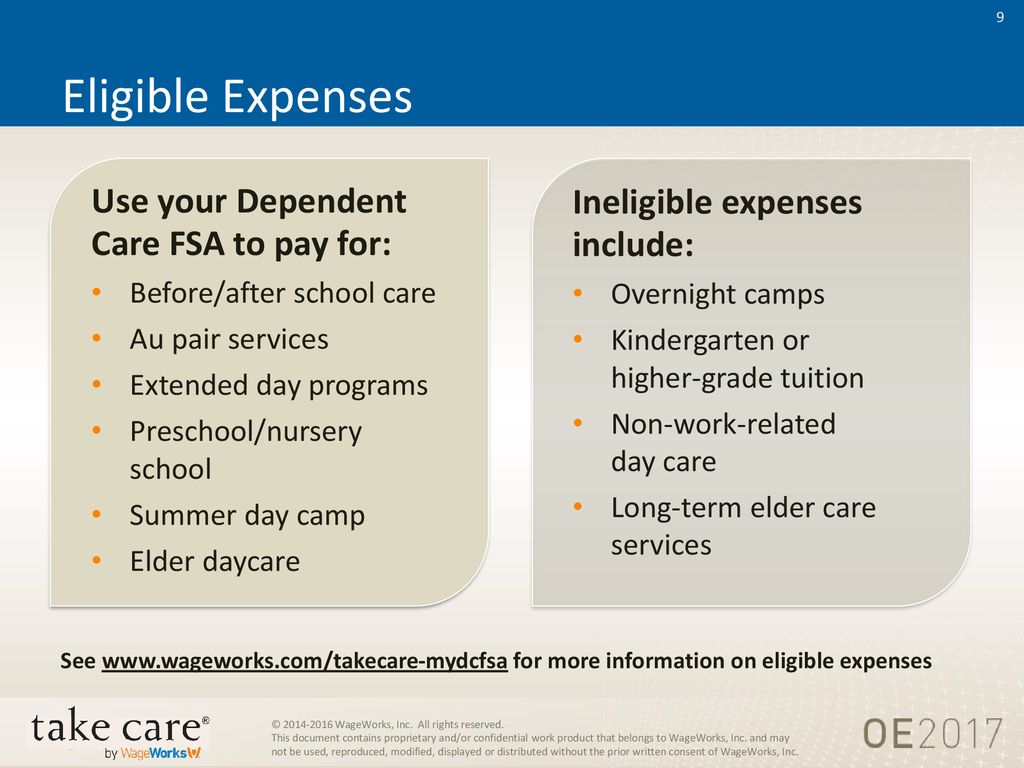

Note that overnight camps and lessons in lieu of day care are not eligible expenses from a Dependent Care FSA.

. Employees can only be reimbursed through their DCFSA for certain qualified expenses. Dependent Care FSA Eligible Expenses. The max for a dependent care FSA is 5000 for 2018.

Easy implementation and comprehensive employee education available 247. When the expense has both medical and cosmetic purposes eg Retin. Medical expenses for a disabled dependent are eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement.

Dependent care FSA-eligible expenses include. Dependent Care FSA Eligible Expenses. These are care services that allow them.

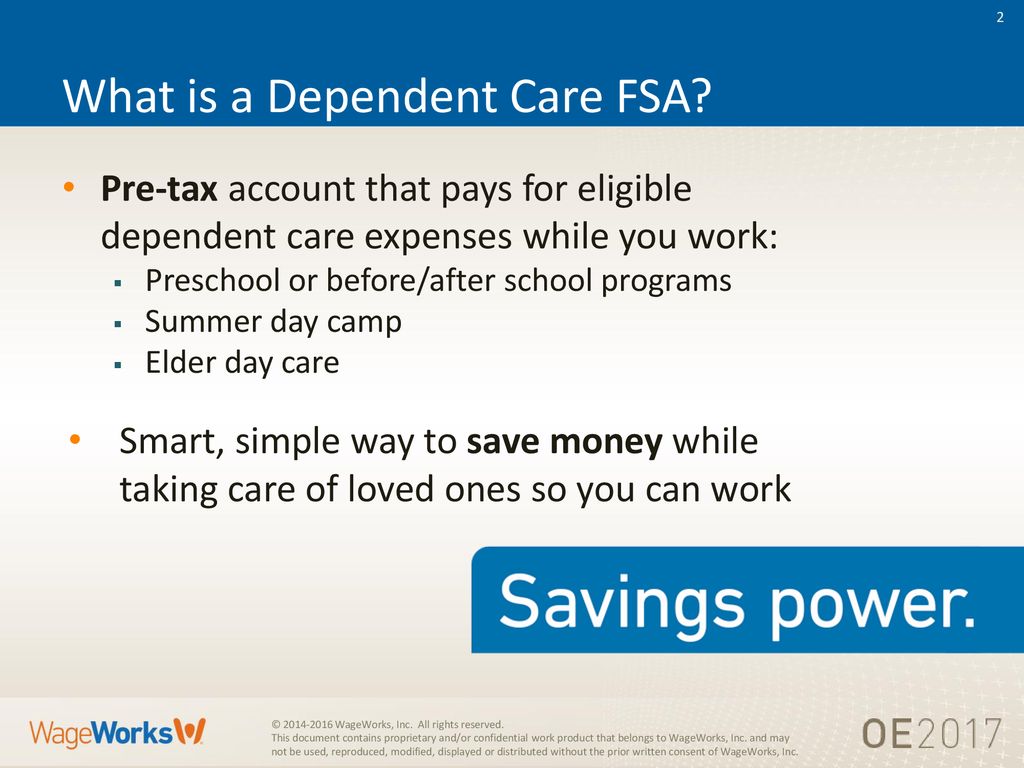

Elevate your health benefits. Cover expenses for your childdependent. Funds are directed into the account free of income and FICA taxes.

If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your. The IRS determines which. Food clothing education or entertainment expenses.

Nursing home care for dependent adults Payroll taxes related to eligible dependent care. A DCFSA can pay eligible expenses for dependent children under age 13. Services must be for physical care not for education meals etc.

The key is that the account funds are used to cover care-related costs that allow you to work look for work or. Nursing home care for dependent adults Payroll taxes related to eligible dependent care. The Savings Power of This FSA.

Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including. Qualified dependents may also include a. Eligible expenses under a dependent care FSA include preschool summer day camp day care and before or after.

You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents. Save money The dependent care FSA lets. A dependent care FSA allows you to put aside a portion of your paycheck before taxes for eligible dependent care expenses each year.

You can use your WageWorks Dependent Care FSA to pay for a huge variety of child and elder care services. Dependent Care Flexible Spending Account eligible expenses are more expansive than many parents realize and narrower than. A DCFSA can significantly reduce out-of-pocket costs for dependent care by saving on taxes.

Dependent Care FSA Eligible Expenses. Medical care for children or dependent adults Nanny for children Nursery school. Medical FSA HRA HSA.

Medical care for children or dependent adults Nanny for children Nursery school. Ad Custom benefits solutions for your business needs. Summer camps for dependent.

Adult day care facilities. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp. Qualified Dependents and Eligible Expenses.

Not all expenses can be covered using a dependent care FSA. Get a free demo. The IRS determines which.

Dependent Care Flexible Spending Accounts Flex Made Easy

Why You Should Consider A Dependent Care Fsa

How To File A Dependent Care Fsa Claim 24hourflex

Health Care And Dependent Care Fsas Infographic Optum Financial

What Is A Dependent Care Fsa Wex Inc

Dependent Care Fsa Flexible Spending Account Ppt Download

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

How To File A Dependent Care Fsa Claim 24hourflex

Dependent Care Open Enrollment 24hourflex

File A Dca Claim American Fidelity

Dependent Care Fsa Dcfsa Optum Financial

Dependent Care Fsa Flexible Spending Account Ppt Download